Table Of Content

- Not Just Ford: Why EV Trucks Are Struggling Across the Board

- Production Cuts, Unexpected Setbacks, and Missed Momentum

- High Consideration, Low Conversion: A Unique EV Problem

- Ford’s Ambitious Projections vs. Reality

- The Real Roadblock: Price Sensitivity Among Truck Shoppers

- What Buyers Actually See Today

- Why Truck Shoppers Walk Away Before Signing

- 1. Loyal F-150 Owners Curious About an EV Upgrade

- 2. First-Time Truck Buyers Exploring EV Options

- What the F-150 Lightning Teaches the Entire EV Industry

- Why Electric Trucks Cost So Much Right Now

- Short-Term Fixes: Hybrids and EREVs

- Hybrids

- EREVs

- The Long Game: Build Cheaper EV Trucks

- But What Happens to First-Generation Models Like the Lightning?

- Key Takeaways

Why Ford’s F-150 Lightning Is Struggling: A Deep Look Into Demand, Pricing, and the Future of Electric Trucks

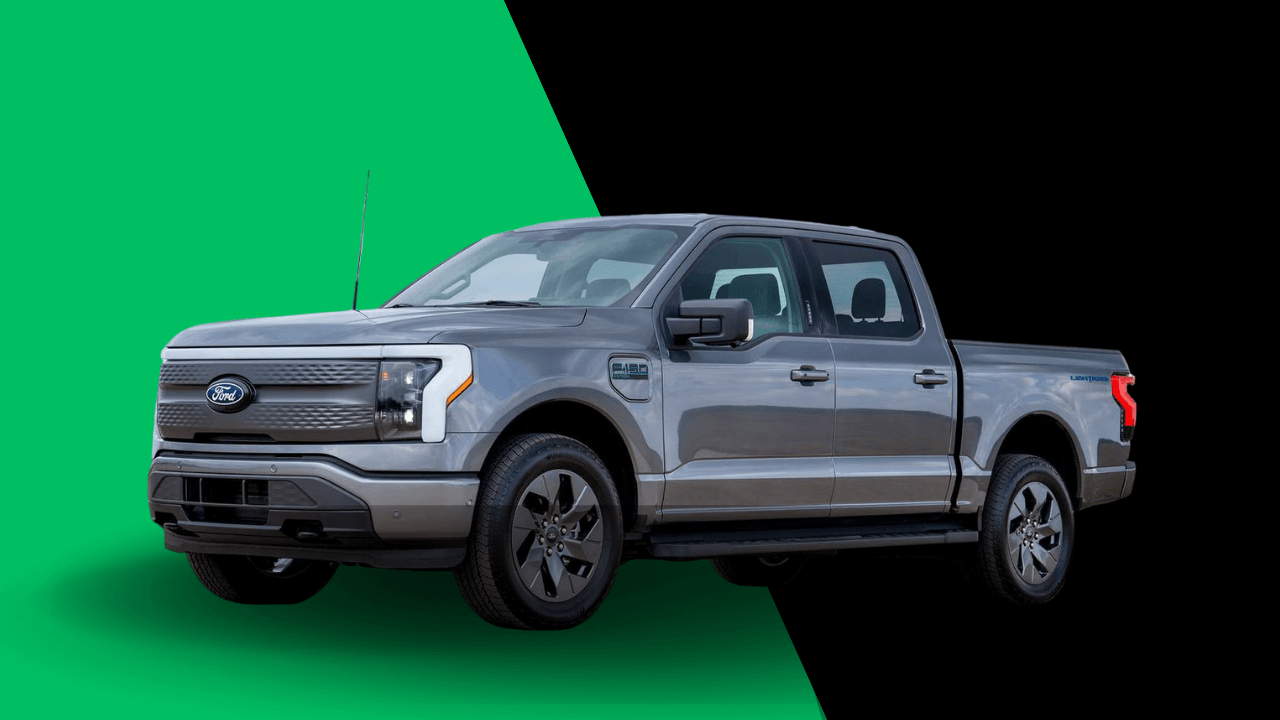

When news surfaced that Ford was considering scaling back-or even discontinuing-the F-150 Lightning, many people weren’t exactly shocked. Anyone paying close attention to the electric truck market could sense the turbulence long before the headlines appeared. Generous incentives, heavy promotions, and jaw-dropping depreciation have become common themes, signaling that something isn’t quite connecting with consumers.

Still, the surprising twist is that interest in the Lightning has always been strong. The curiosity is there. The excitement is there. The recognition is there. So why aren’t people buying the truck in the numbers Ford had hoped for?

According to industry analysts, the Lightning’s challenge isn’t a lack of attention-it’s a mismatch between consumer expectations, pricing reality, and the current state of EV technology.

Not Just Ford: Why EV Trucks Are Struggling Across the Board

Brent Gruber, who leads the EV research division at J.D. Power, believes the issue runs deeper than Ford or the F-150 badge.

“This isn’t something specific to Ford. Most automakers expected their EV models to perform better in the market,”

— Brent Gruber, J.D. Power

He explained that while electric vehicles have made major progress, they still sit in an awkward space. Many early EV buyers cared more about innovation than price, but the mainstream shopper-especially the truck buyer-thinks very differently.

Where Ford differs from other manufacturers is the level of initial buzz around the F-150 Lightning. The curiosity was enormous. The brand recognition of the F-150 nameplate was a massive advantage. On paper, Ford had the perfect recipe to dominate the electric truck space. But turning interest into action turned out to be much harder than expected.

Production Cuts, Unexpected Setbacks, and Missed Momentum

Even though the Lightning had a strong launch, Ford kept walking back its production targets. What started as an ambitious plan to scale quickly became an exercise in managing disappointment.

At one point, a fire at aluminum supplier Novelis led to a serious shortage of a critical material. Rather than protecting Lightning production, Ford chose to prioritize the highly profitable gas-powered F-150 models. This decision sent a very clear message: demand for the Lightning wasn’t strong enough for Ford to sacrifice its traditional best-sellers.

From the outside looking in, this made it seem like the EV truck market wasn’t maturing quickly enough to justify the initial hype.

High Consideration, Low Conversion: A Unique EV Problem

One of the most interesting contradictions in the Lightning story is how highly considered it has always been. According to J.D. Power, it consistently ranks among the top three most researched and considered EVs on the market-often landing right behind the Toyota bZ4X and Honda Prologue.

People look at it. They watch reviews. They read articles. They add it to their “maybe” list. But somewhere between curiosity and purchasing, something breaks down.

Ford’s Ambitious Projections vs. Reality

Ford’s public production estimates over time:

| Ford’s Target | Volume |

|---|---|

| Initial | ~40,000 trucks/year |

| Updated | 80,000 trucks/year |

| Later Projection | 150,000 trucks/year |

| Actual Sales (Last Year) | 33,510 trucks |

On the surface, 33,510 units doesn’t look terrible. It even made the Lightning the best-selling electric pickup in the U.S. But that title doesn’t mean much when compared to the gasoline truck market, which absolutely dwarfs EV trucks.

The Real Roadblock: Price Sensitivity Among Truck Shoppers

One of the biggest misconceptions around electric trucks is that consumers don’t want them. That’s not true at all. Plenty of people want an EV truck-it’s the price that sends them running.

When the Lightning was first teased, Ford hinted at a $40,000 entry price. Tesla did the same with the Cybertruck. But once real-world models hit dealership floors, the numbers quickly changed.

What Buyers Actually See Today

- Base electric truck: around $60,000

- Long-range or mid/high trims: $70,000 to $85,000+

For someone earning six figures, that’s still a serious purchase. But here’s the kicker:

70% of people seriously considering an F-150 Lightning earn $100,000 or less.

Gruber highlights this as one of the most important insights. Many shoppers love the idea of the Lightning, but their budget simply doesn’t stretch far enough.

Why Truck Shoppers Walk Away Before Signing

People love electric trucks on paper: quiet ride, surprising performance, fast acceleration, and low fueling costs. But when buyers compare real pricing, range, towing limitations, and charging concerns, the enthusiasm starts to fade.

Most Lightning shoppers fall into two groups:

1. Loyal F-150 Owners Curious About an EV Upgrade

These shoppers tend to price-compare directly against the gas or hybrid F-150, which often costs tens of thousands of dollars less.

2. First-Time Truck Buyers Exploring EV Options

These shoppers often experience sticker shock when they discover that EV trucks don’t have “budget-friendly” trims the way gas trucks do.

And then there’s the psychological hurdle: if someone expresses even a hint of uncertainty about EV ownership, a dealership can immediately steer them toward a familiar gas model. Dealers often prefer selling gas trucks because:

- They generate higher service revenue

- They are easier to sell

- Buyers understand them better

- The upfront cost is lower

In short, the Lightning ends up losing the sales battle before it even begins.

What the F-150 Lightning Teaches the Entire EV Industry

The Lightning’s situation reveals a crucial lesson for automakers: attracting interest isn’t enough-EVs must also solve the real barriers preventing sales.

For truck buyers, those barriers are substantial:

- High initial cost

- Uncertainty about EV towing capability

- Range anxiety on long trips

- Lack of affordable entry-level models

- Confusion about charging options

These problems aren’t easily fixed overnight.

Why Electric Trucks Cost So Much Right Now

Truck buyers expect:

- Big range

- Big towing

- Big payload capability

And delivering all that requires one thing: a very large, very expensive battery pack.

Large batteries significantly increase the total cost of building an EV truck. Even if Ford wanted to drop the price tomorrow, the battery cost alone makes that almost impossible.

Short-Term Fixes: Hybrids and EREVs

Because fully electric trucks are expensive to build, many analysts believe the near-term solution isn’t pure EVs-it’s hybrids and extended-range electric vehicles (EREVs).

Hybrids

- Provide better fuel economy

- Don’t require a charging lifestyle

- Cost much less than full EVs

- But lack the full benefits of EVs

EREVs

- Drive like EVs most of the time

- Small gas engine acts only as a generator

- Reduce range anxiety

- But pricing and long-term adoption remain unknown

The Long Game: Build Cheaper EV Trucks

Ford knows affordability is the key to winning this category.

Ford spokesperson Emma Bergg revealed that Ford is preparing:

- A universal EV platform for cost-efficient future models

- A mid-size electric truck launching in 2027

- An expected starting price around $30,000

That price point could be a true game-changer. It targets the exact demographic that loves trucks but can’t justify today’s EV prices.

But What Happens to First-Generation Models Like the Lightning?

This is the part that still feels uncertain.

The F-150 Lightning is expensive to build, and likely unprofitable at today’s volumes. Federal tax credits are changing. Regulations are shifting. And consumer expectations continue evolving.

Gruber believes Ford may need to rethink the Lightning’s packaging-perhaps offering less premium features to reduce the price. Tesla did this with the Model 3 and Model Y, offering simpler variants at lower costs.

Whether Ford takes this approach remains an open question.

Key Takeaways

- The F-150 Lightning suffered not from lack of interest, but from pricing and market timing issues.

- Most shoppers interested in an EV truck can’t justify the cost, even with incentives.

- Ford faced multiple production setbacks, reducing momentum.

- Electric trucks remain expensive due to large battery requirements.

- The next wave of electric trucks will need to be affordable first, advanced second.

- Ford’s upcoming $30k electric truck may finally align EV trucks with mainstream budgets.

Additional Reading: